A Transitional Real Estate Company, “bonding humans to earth”

Mission

Educate investor community about an under leveraged asset class – “Land Banking”.

WHO ARE WE?

- A small group, passionate about land banking

- A Land Banking company with high-quality transitional assets across 8 states in the US

- Aspiring to be a vertically integrated real estate company

- Our core values are HITT – Honesty, Integrity, Trust, and Transparency

WHY ARE WE HERE?

- To share

- Our story of how we turned $100K to $1M in 3 years.

- Our journey of creating financial independence

- A template that repeatedly worked for us, again and again

- A template that we believe with zero downside.

- To empower investment community with land banking knowledge and information

How we turned $100K investment to $1M ?

- This is a story of many of our partners.

- Example asset – 120 acres for $1.2M at $10K per acre

- $300K investment with 30% down payment ($90K)

- 25% share for $300K

- Hold period 2 years.

- EMI payment for 2 years – $30K

- Sell for $4.2M at $35K per acre.

- 25% share of sale – $1M

- After loan repayment – Cash on Cash 800% return

- This is not an exception. Many of our properties have these kinds of returns.

How we turned $100K investment to $1M ?

- Wholesale buyer – volume pricing

- Ample buying power

- Off market deals

- Average purchase price – $8K to $15K per acre

- Bargain deals with aggressive closing and high earnest money

- Leverage agricultural banks.

- Income generation through leases

- Partial sale to reduce debt and cost basis.

- Relentless focus on value creation

Our Due Diligence checklist

- Property in the growth path

- Income producing, partial sale, and flipping possibilities.

- Flood Plain, Wetlands

- Pre-App Meeting with the county on future possibilities

- Density, Current and Future zoning

- Setbacks, Water, Septic, and Electric Easements review

- Alta Survey

- Phase-I Inspection

- Title Commitment Review

- Soil Testing

- Mineral Rights Review

- Water Rights Review

- And…, shortlisting low maintenance investors 🙂

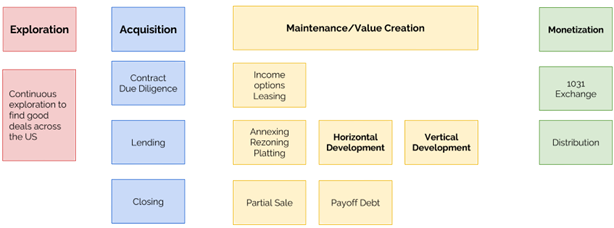

Project Life Cycle

Entity/Asset Maintenance tasks

- .Very Low Entity/Asset Maintenance Costs – 0.5% per year vs industry standard of 1.5% to 2%

- Site visit Travel Expenses (accommodation, flight, car, & meals)

- Issue Operating and Contribution agreements.

- Utility Payments

- Repairs & Maintenance

- Renewing permits etc

- Liability Insurance & renewals

- Audit compliant Accounting/Bookkeeping

- Filing Entity Taxes (tax filing fees included)

- Maintaining Ag Exemption

- Issuing K1s

- Issuing Fair Market Value reports

- Manage child entities audit compliant bookkeeping-optional service.

- Explore lease options.

- Software licensing costs.

Rao Bondalapati

- 9192701008

- Port St Lucie, FL 34986

- bondestates.us